The federal government plans to boost funding to some lenders by $2 billion to help small businesses get funding at lower costs.

Small and medium-sized businesses will be able to borrow money on more competitive terms, when the federal government ramps up the funding available to smaller lenders by $2 billion.

The money will be made available to smaller banks and non-bank lenders over the coming years through a new Australian Business Securitisation Fund.

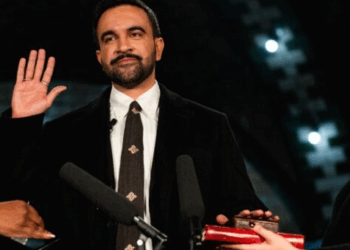

The step will allow such institutions to lend the money to small businesses at a lower cost than what is currently available, Treasurer Josh Frybenberg says.

“Small businesses find it difficult to obtain finance other than on a secured basis – typically against real estate,” he said on Wednesday.

“Even when small businesses can access finance, funding costs are higher than they need to be.”

The new fund will be administered by the Australian Office of Financial Management.

The coalition is also encouraging banks to create an Australian Business Growth Fund that would help small businesses access longer term equity funding.

“Many small businesses find it difficult to attract passive equity investment which enables them to grow without taking on additional debt or giving up control of their business,” Mr Frydenberg said.

The business growth fund would be following in the lead of similar funds internationally, including one in the United Kingdom.

Unfavourable treatment of equity for regulatory capital purposes has been part of why such a fund has not yet emerged in Australia, Mr Frydenberg said.

“APRA (the Australian Prudential Regulation Authority) has indicated that it is willing to review these arrangements,” he said.