Gig economy platforms Uber, Airbnb and Airtasker say they are consulting with the Federal Government about how they can adhere to a new reporting regime being considered as part of a crackdown on people dodging their taxes by under-declaring income.

A Treasury paper released on Wednesday suggests all gig, or sharing, economy providers could be subject to a new reporting regime.This would ensure the ATO has greater visibility and that Australians are correctly reporting income from activities such driving an Uber, renting out a room on Airbnb, completing a chore in Airtasker or delivering a pizza via Deliveroo.

The paper follows a recommendation from the Federal Government’s Black Economy Taskforce, which last year made a host of other recommendations including.

Australia’s sharing economy was worth an estimated $15.1 billion in February 2017 and about 10.8 million Australians, or 60 per cent of the workforce, were thought to have earnt extra money from sharing economy services between July to December 2017.

The Federal Government has no estimate of the tax lost from potential underreporting of income or outright tax avoidance.But the gig economy is growing and the Treasury paper suggests it is time platforms report data to the Australian Taxation Office like other third parties, such as banks, which report income, and corporates, which report dividends.

Pre-filled tax returns with Uber income

The new reporting regime would also result in more pre-filing of peoples’ tax returns.

An Uber spokeswoman welcomed the proposed move to make companies report the data directly to the ATO.

“We look forward to participating in the upcoming consultation process and working with Government on ways that make it easier for driver partners using the Uber app to meet their tax obligations,” she said.

Airbnb said it will consider the paper and “looks forward to working with Treasury throughout the consultation process”.

Compliance manager at Car Next Door, Kate Trumbull, also said they would adhere to any new reporting regime.

“We don’t see this initiative as a problem for car-sharers or for us at all,” she said.The ATO recently provided a summary statement on all the deductions car-sharers can claim, and now this would make it easier for users by pre-filling information on their tax returns.The Treasury paper said there could be exemptions for smaller players. It suggested start-ups in the sharing economy could be given a grace period from reporting obligations.

Ms Trumbull said she thinks it worth exploring a carve-out for start-ups.

“We are at a size now that we can report, but when we were starting out with just three people, that would have been difficult to do. Start-ups are operating on a shoestring and adding an extra compliance burden could make things difficult for them.”

Gig economy users earn low wages

CPA Australia’s Paul Drum said a new reporting regime would bring gig economy providers into line with other third parties, such as the banks, which already give the ATO data that it uses to pre-fill tax returns.

“Nobody has any idea about the current level of tax compliance by users — whether it is from dog sitting to building furniture from Ikea as part of Airtasker to driving an Uber,” he said.

“The ATO will get data directly instead of chasing data from the Ubers and Airbnbs.

“It seems logical and it wouldn’t be huge compliance burden on the sharing economy platform providers. Platforms would see it as a bug bear but not a show stopper; it’s in their interests to comply.”

He said it would also enable a variety of government agencies to determine whether people should be getting welfare payments and other benefits.

“A pensioner couple might have been renting out the back room to supplement their income, but don’t want to declare it because it will impact the means test for welfare benefits,” he said.

But economist Alison Pennington, who is with the Centre for Future Work at The Australia Institute, said the Federal Government ought to be going after multinationals, not individuals.She said people working through digital platforms often earn very low wages.”Our research estimated average hourly incomes of Uber drivers are well below Australia’s basic statutory minimum wage of $18.29 per hour,” she added.

Data privacy concerns remain

The paper also noted data privacy concerns, as it involves sellers’ data being shared with both platforms and buyers.

That is an issue that concerns Air Tasker co-founder Tim Fung.

“We believe that everyone should meet their tax obligations and pay their fair share of tax,” he told the ABC in a statement.

“We also believe that the vast majority of people want to contribute and government should carefully consider the impact of additional surveillance on the privacy of Australians.”

The other difficulty, the paper observed, is data protection requirements applying in other jurisdictions.

It argued this may “create an additional challenge for sharing economy platforms in meeting the reporting obligations under Australia’s potential sharing economy reporting regime” and could “create an uneven level playing field between domestic and international platform operators”.

The Treasury paper also suggested a second option of using banks and the financial sector to track income and transactions.

But the Federal Government’s tax advisory board, the Board of Taxation, looked at that option previously and said obtaining appropriate data from banks “was not a desirable option” because data may not be available or might be low quality.

Tech giants, including Uber and Airbnb, have long been working with the ATO on sharing data and providing direct reporting of the income earned by users.

The ATO currently has information-gathering powers to direct these platforms to provide data it needs, but the process can be time consuming.

Future option: withhold income from users

The ATO also recently changed the law to make it clear that Uber and other ride-sourcing drivers are required to register for and pay GST.

The Treasury paper noted that — following ATO data matching, guidance on tax obligations and education campaigns in ride-sourcing — GST registrations of active drivers increased from 52 per cent in the first quarter of 2016 to 73 per cent in the first quarter of 2018, with ABN registration rates now at about 82 per cent.

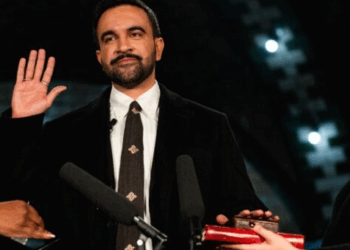

The reforms proposed in the Treasury paper were released on Wednesday by Assistant Treasurer Zed Seselja, who said he was worried some individuals are not reporting their full income, and thereby avoiding tax.

The paper also highlighted the Black Economy Taskforce’s report recommendation to continue education programs and keep raising users’ awareness about potential tax obligations from participating in the gig economy.

The Taskforce’s report noted that, should people keep dodging their taxes, in future the Federal Government might want to consider requiring sharing economy platforms to deduct income tax from payments made to sellers, which would be remitted to the ATO.

However, for the time being, the Taskforce’s report found that a withholding regime for sharing economy platforms would be “relatively onerous”. abc.net.